Indianapolis Recorder’s Smart Money Week continues with Everwise Credit Union sharing steps for helping your kids develop smart financial habits for future success.

Teaching kids about money is an exciting way to set them up for future financial success! Here are nine steps to help them develop smart financial habits early on:

- Discuss finances with your children and highlight important milestones that will motivate them to take on new “big kid” responsibilities. After your talk, plan a visit to a bank or credit union to make the experience more hands-on. A great time to visit to make deposits is when they receive money for completing chores or celebrating birthdays and graduations. Regular visits can also help instill good habits and a sense of responsibility.

- Look into savings programs designed for children, such as Everwise’s Kids Club, which is a savings account designed for kids up to age 12. Parents or guardians can open a membership with the child as the primary owner. Kids receive a piggy bank and can access free online financial tools, helping both parents and kids learn about money together.

- For teenagers, opening a Student Rewards Checking account is a great way to manage money and earn cash rewards. This account offers 24/7 banking, a cash-back debit card for everyday purchases, and rewards teens for learning about money management.

- For children under 18, a parent is required to help open the account. So, you can help your child choose log-in information and passwords and help monitor their transactions, spending, and savings habits. Once your child turns 18, you can decide whether to continue monitoring the account together or step back.

- Set both monthly and yearly spending and saving goals. When they receive money, discuss the importance of balancing how much should be saved versus spent. If they’re hesitant to save it all, encourage a 50/50 split. Emphasize the importance of keeping receipts and monitoring their balance to see how their savings grow.

- Help your child learn key financial concepts and banking terms like savings, deposits, withdrawals, and interest. Understanding these terms will set them up for success and teach them the importance of delayed gratification. Be sure to check out our next article for an in-depth look at compound interest.

- Teach budgeting. Show kids how to divide their money into categories like savings, spending, and giving. You can use simple examples like budgeting for a school trip or managing weekly allowances. Tracking their spending against goals will help them become more aware of their financial choices.

- Instill the value of giving back! Teach your child to set aside a portion of their money for charitable donations. This shows them that money can be used to help others and make a positive impact.

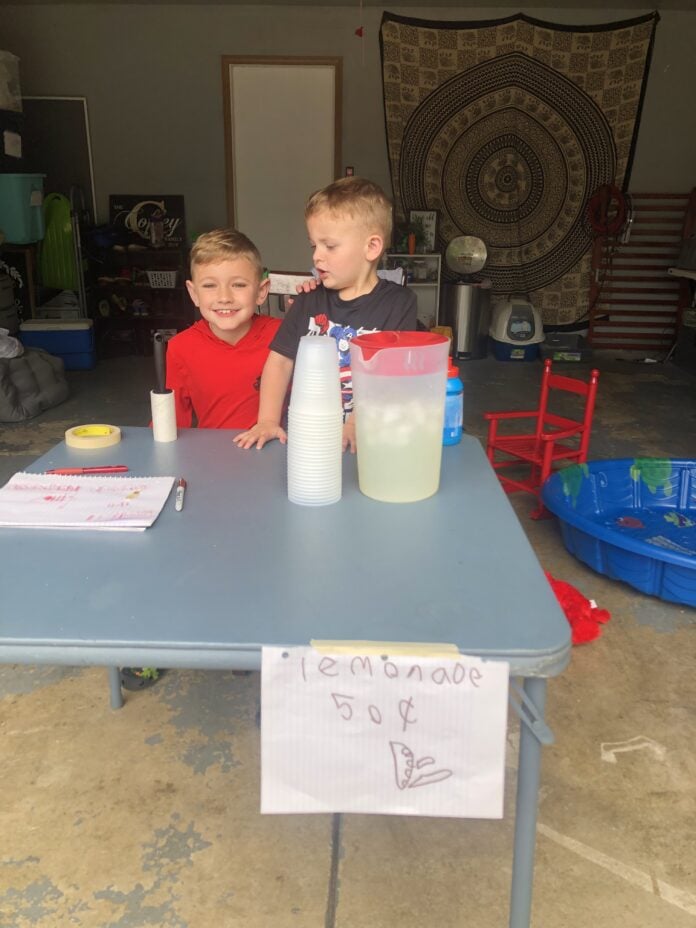

- Let them explore earning money through small jobs or entrepreneurial ventures like babysitting or selling crafts. This teaches the value of hard work and the satisfaction of earning their own money.

Following these steps will equip your kids with the skills and mindset to become financially confident and independent—an investment that pays off for a lifetime.

Catrina Tate is Vice President of Retail at Everwise Credit Union with 21 years of banking experience and is active in the Indianapolis community.