Indianapolis Recorder’s Money Smart Week continues with Everwise Credit Union sharing strategies for paying down debt.

Paying down debt is important to your financial wellness because it helps you make the most of your money. The less money you pay in interest fees, the more money you’ll have to put towards your goals. Paying down debt is possible if you strategize!

Here are 8 steps to pay down your debt:

- Create a budget to know your income, expenses, and cash flow. Look back at Tuesday’s post from our daily financial wellness topics for help.

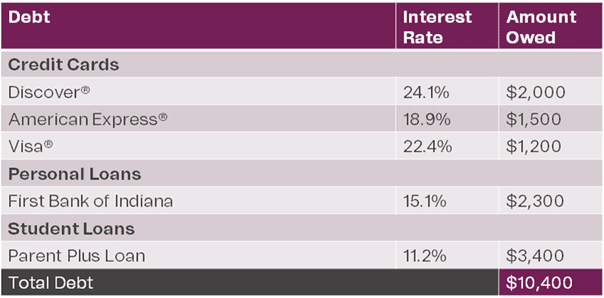

- Organize your debt. Determine how much debt you have. List every credit card with an outstanding balance and note the amount owed to each. Next, list the interest rate of each card. Do this for any other fixed installment loan debt you have as well. Then add up the amounts owed on each account to reach your total outstanding debt amount.

- Trim nonessential expenses and/or generate more income to have as much cash flow as you can. By trimming spending in one budget category and channeling that money toward paying down debt, you can maximize your debt payments. You can also find ways to make extra cash to cover your payments.

- Choose your debt-crushing method. Consider the Snowball or Avalanche method: The Snowball Method commits as much income as you can to your lowest debt while making only minimum payments on the rest. OR The Avalanche Method pays off debt with the highest interest rate first and moving on to the next-highest rate until all debts are paid off, while maintaining minimum payments on the rest of your debt.

- Negotiate with your creditors. Many credit card companies are willing to lower your interest rate once you prove you are serious about paying down debt. Contact each credit card company to discuss your options. At the very least, see if you can get the company to lower your rate.

- Consider a debt consolidation loan or credit card balance transfer. For some, the most challenging aspect of paying down debt is managing multiple payments across several credit card accounts. When you consolidate debts into one low-interest loan, it becomes much easier to manage monthly payments. Plus, the savings on interest payments can be significant, particularly if the new loan has a low interest rate.

- Avoid debt settlement services. Debt settlement services offer to lower your interest rates and boost your credit score in a short amount of time – for a fee. Although many of these companies could be fronts for scammers and should be avoided, there are legitimate debt settlement companies, so do your research well if you are thinking of using one.

- Start building your emergency savings and stop taking on new debt. Emergency savings can help you from taking on new debt due to unexpected expenses.

Paying off debt takes time and willpower, but living debt-free is key to financial wellness.

Catrina Tate is vice president of Retail at Everwise Credit Union with more than 21 years of banking experience. Visit everwisecu.com.

For more news from the Indianapolis Recorder, click here.