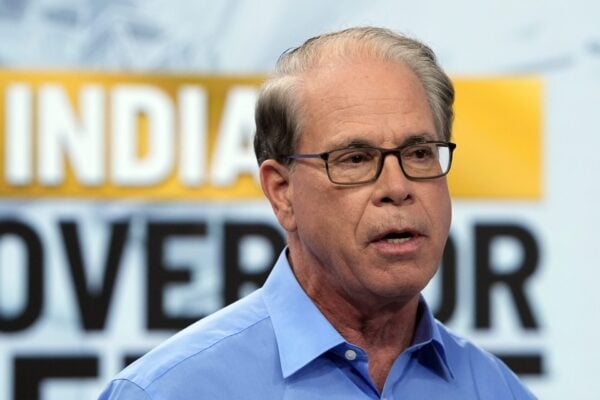

Gov. Mike Braun signed Senate Bill 1 (SB 1) into law, enacting a significant overhaul of the state’s property tax system. The legislation, described by supporters as “historic tax relief,” aims to provide substantial savings for homeowners, farmers and businesses. However, critics express concerns about potential funding shortfalls for local governments and schools.

SB 1 introduces several changes to Indiana’s tax structure:

- Property tax credit: Homeowners will receive a 10% credit on their property tax bills, capped at $300 annually, beginning in 2026. This measure is projected to save homeowners approximately $1.2 billion over three years.

- Business personal property tax reform: The bill raises the exemption threshold for business personal property tax from $80,000 to $1 million in 2025 and to $2 million in 2026. Additionally, it exempts newly acquired property from the 30% depreciation floor, aiming to reduce compliance burdens for businesses.

- Farmland assessment adjustments: SB 1 modifies the assessment process for farmland, intending to lower property taxes for farmers.

- Local income tax provisions: The legislation allows cities and towns with populations over 3,500 to establish their own local income tax rates, providing an alternative revenue source for local governments.

Braun emphasized the bill’s alignment with his “Freedom and Opportunity Agenda,” stating that it “cuts property taxes for most Hoosier homeowners, farmers and businesses, limits future tax hikes and makes the tax system fairer, more transparent, and easier to understand.”

The Indiana Chamber of Commerce praised the legislation, highlighting its potential to foster a favorable environment for capital investment and support the growth of key industries in the state.

However, the bill faced criticism from various quarters. The Indiana Senate passed SB 1 with a narrow 27-22 vote, with 12 Republicans joining Democrats in opposition. Concerns centered around the projected $1.5 billion revenue loss for local governments over three years, including an estimated $744 million shortfall for public schools.

Educators and public school advocates expressed apprehension about the potential impact on school funding. Teachers rallied at the Indiana Statehouse, warning that the revenue losses could lead to job cuts and reduced services for students.

Contact Health & Environmental Reporter Hanna Rauworth at 317-762-7854 or follow her on Instagram at @hanna.rauworth.

Hanna Rauworth is the Health & Environmental Reporter for the Indianapolis Recorder Newspaper, where she covers topics at the intersection of public health, environmental issues, and community impact. With a commitment to storytelling that informs and empowers, she strives to highlight the challenges and solutions shaping the well-being of Indianapolis residents.

Governor Braun’s tax relief bill is a significant step toward easing the financial strain on property owners, particularly seniors and veterans. While it provides relief, balancing local government costs with tax reductions remains a critical challenge.