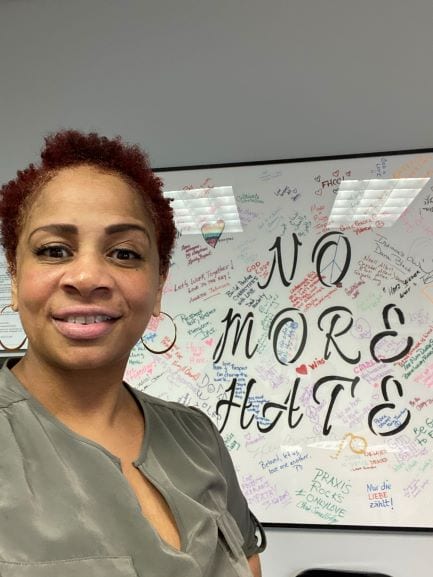

Carlette Duffy wanted to refinance her home so she could buy her grandparents’ old house and keep it in the family.

There was a problem, though. Two appraisals left her with little equity after she purchased her home three years ago in a neighborhood on the near northwest side.

The appraisals came back with estimated values of $125,000 and $110,000. She purchased her home for $100,000 three years prior. The house had to be almost completely renovated, she said, after a fire destroyed it years ago.

Duffy, who works for the city, decided to try an experiment. She contacted a third lender for another appraisal, but this time didn’t include her race or gender on the application.

She interacted with the appraiser through email only and removed anything from the home that would have identified her as African American, including pictures, art and books. She also told the appraiser she would be out of town and had a white friend pretend to be her brother who met the appraiser at the house.

That appraisal returned an estimated value of $259,000.

“Only when I removed myself did I increase the value,” Duffy said. “So I’m being seen as the object of devaluation in my home, and that part hurts. That’s the part that’s hard to get over.”

The Fair Housing Center of Central Indiana (FHCCI) filed complaints with the U.S. Department of Housing and Urban Development (HUD) alleging discrimination against Duffy because of her race and color.

The complaints, available on FHCCI’s website, allege the appraisers violated Title VIII of the Civil Rights act of 1968, which prohibits discrimination in real estate transactions based on race, color, religion, sex, handicap, familial status or national origin. HUD will investigate to determine any violations of the law as part of the complaint process.

Neither appraiser — Tim Boston of Appraisal Network and Jeffrey Pierce of Pierce Appraisers — could be reached by phone. A man who said he is Pierce’s son said his father didn’t want to comment.

Duffy said she got the idea to remove any indication of her race from a New York Times article in 2020 that told the story of an interracial couple in Florida who essentially did the same thing. The wife, who is Black, removed pictures, books, anything that might tell the appraiser she’s Black. The result was a 40% increase from their first appraisal.

“You want to believe that you’re being treated fairly,” Duffy said. “You want to believe that what the appraiser is saying is true.”

Duffy paid for a market analysis that determined a possible list price for her home was $187,000, but the appraisal amounts didn’t change despite that.

Freedom Mortgage, which Duffy worked with between May and July 2020, lists a press contact on its website, but the contact did not respond to a request for comment.

Teresa Whitehead, CEO of Citywide, the first lender Duffy worked with in March and April 2020, said the rise in appraisal value from Duffy’s experiment could have been because it was a “very, very unusual year in the mortgage business.”

“We did see values go up considerably in a short period of time last year,” she said.

Whitehead, the only person who spoke to the Recorder at length about the allegations, said if there was discrimination, it would be on the part of the appraisal management company, not the lender.

She also said the lenders’ role in the appraisal process is limited because of the Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010. The act emphasizes “appraisal independence” but leaves lenders with options to ask an appraiser for an explanation of the value or “correct errors” in the report.

Congressional Research Service wrote Dodd-Frank “also mandates that professionals who have a reasonable basis to believe that an appraiser is failing to comply with the [Uniform Standards of Professional Appraisal Practice], violating applicable laws, or otherwise engaging in unethical or unprofessional conduct, refer the matter to the state appraiser certifying and licensing agency.”

Whitehead said Citywide requested a reconsideration of value from the appraiser (which was denied) but did not respond to a follow-up question about why the company didn’t request another appraiser.

Myra Lillard, owner and chief appraiser of Home Guide Realty Services, said a lender that has already requested a reconsideration of value should go to the appraisal management company and request another appraiser.

“I’ve not heard of a lender that can’t order another appraisal,” said Lillard, who is also part of the National Society of Real Estate Appraisers.

A 2018 study from Brookings Institution found homes in neighborhoods where the share of the population is 50% Black are valued at about half the price as homes in neighborhoods with no Black residents.

FHCCI Executive Director Amy Nelson said part of the reason this problem persists is because the appraisal industry has created a false perception that appraisals are mostly subjective.

“I think that we have allowed the appraisal industry to be able to push off checks upon them by convincing all of us that it’s art over science,” she said.

Duffy knows she has opened part of her life to the world and said she’s already heard from others who think they were discriminated against. She said it can feel overwhelming but decided to share her experience anyway.

“I want to see the system changed,” she said. “I don’t know if we can, but I’m up for the fight.”

Contact staff writer Tyler Fenwick at 317-762-7853. Follow him on Twitter @Ty_Fenwick.